Founder Profile

M.V. Narasinga Rao

M.V. Narasinga Rao is the founder and chief strategist of Sampadha, a Financial Consultant firm

He is a Financial Consultant, Research Analyst, Speaker, Finfit Mentor, Coach, and Author

Sampadha is a PFRDA Registered Retirement Advisor and SEBI Registered Research Analyst firm

He helps Families and Small Businesses to grow financially and achieve their goals in the safest and shortest way possible

Key Qualifications

1. Bachelor of Sciences, Andhra University, Visakhapatnam, India

2. Financial Planner, FPSB, USA

3. Management Development Program, IIM, Lucknow, India

4. National Institute of Securities Market, India

5. Certified Technical Analyst, New Delhi, India

6. Post Graduate Certificate in Fintech, NSE & IMT, Hyderabad, India

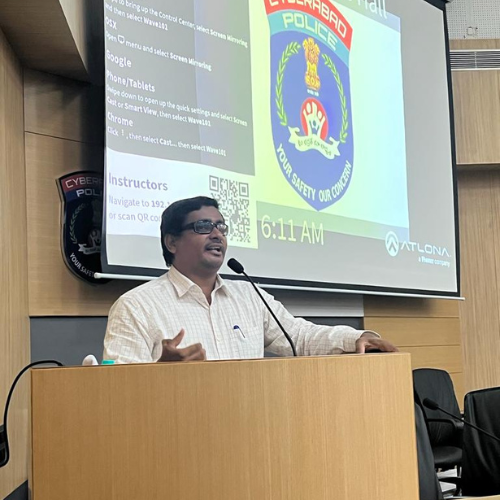

Speaker at Financial Awareness Programs

1. Seminars - 145

2. Webinars - 375

3. Tv Shows - 85

4. YouTube Shows - 170

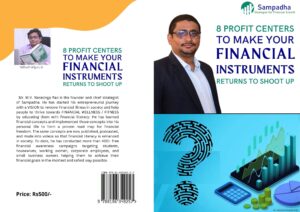

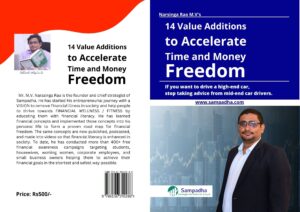

Author

What Led to the Start of Sampadha?

As a Research Analyst, Financial Planner, Investment Advisor, Investor, and Trader with over 15 years in Financial Services Industry.

Mr Narasinga Rao realized that most of the middle-class families are not able to elevate to next level due to no clear process of financial planning and he also believes that market participants (Investor and Trader) are underutilizing their assets and capital markets to get the most out of it.

Most of the participants are seen using capital markets at extreme ends

1. Either using capital markets as another avenue to save money and buy assets like in other fixed assets (Buy, Hold and Pray)

Or

2. using it as a gambling arena to get rich in a short period of time

Narasinga Rao opines about Capital markets / financial markets participation that it should be treated as a business where active involvement is needed for making the most and the best from the capital markets, spanning from screening multiple opportunities to investing, trading, selection of opportunity, allocation of adequate money resources, implementation of strategy, reviewing it and adjusting it as per market dynamics to get better risk-adjusted returns.

His idea is to make sure that clients make the best income for the investment and risk taken by clients. His core expertise is using different instruments and active strategies to get the most and best from the markets, he also believes in both timing the markets and time spent in the market to compound wealth and get regular income from markets.

Vision

His VISION is to remove the FINANCIAL ILLNESS of all his clients and stakeholders and thrive towards FINANCIAL WELLNESS via FINANCIAL FITNESS of by suggesting suitable services, products and solutions to stakeholders.

He provides valuable advice on financial discipline, risk mitigation, income generation and wealth creation, wealth management, and comprehensive financial planning adding almost 150 value additions to clients, customers and stake holders.

He aspires to take the happy and financially fit business and families count to over 1 lakh in the next 10 years.

Professional Summary

Professional Qualifications

- Post Graduate Diploma in Fintech, Institute of Management Technology (IMT), Hyderabad

- Management Development Program, Indian Institute of Management (IIM), Lucknow

- Research Analyst from National Institute of Securities Market

- Retirement Advisor from National Institute of Securities Market

- Certified Technical Analyst from Association of Technical Analyst

- Certified Financial Planner, FPSB India

Speaker at 400+ Events and Tv Shows

In collaboration with SEBI, CDSL, NSDL, NSE, BSE, Karvy, Eenadu, Sakshi, CVR News, CVR Telugu, India Ahead, Suman TV, Swatantra TV

Expertise

1. Business Strategy

2. Financial Planning and Management

3. Capital Market Research, Technical and Derivative Analysis

4. Asset Allocation and Investment Management

5. Wealth Management

6. Author and Podcaster

7. Time Management

8. Business Strategy

9. Communication

Experience

1. Sampadha : Sole Proprietor and Founder

2. Karvy Stock Broking Limited : Investment Strategist, Portfolio Counsellor and Research Analyst

3. Ramoji Group, Ushodaya Enterprises : Content Writer and Website Consultant

4. Meticulous Financial Planner : Client Research Analyst and Junior Financial Planner

5. ITI Financial Services : Research Analyst

6. Nirmal Bang Securities Pvt Ltd : Investment Consultant

7. ITI Financial Services : Investment Consultant

Some Highlights

Rao Sir's 12-Step Process for your Financial Freedom

- Build network or product or service or skill which is needed by society

- Earn Active Income

- Control or Reduce Expenses

- Convert Savings into Investments

- Let Investments Multiply by Capital Appreciation, Not Just Addition

- Protect or Cover Multiplying or Capital Appreciation Assets

- Book Partial Profits from multiplied Capital Appreciating Assets and invest in Income Gen Assets

- Get or Build multiple Passive Incomes

- Leverage MERIT to Scale up aggressively (Derivatives, Leverage, OPmoney, Efforts or Energy OPExperience, OPEnergry, OPtime, Relationship OPKnowledge, Intelligence, OPSkill, OPExpertise, Time or Technology)

- Insure or Protect or Cover Income Generating Assets

- Build Lifestyle and Own your House

- Increase Financial Knowledge to earn more with 0 Investment

34 Assets for your Financial Freedom

The below are the list of assets, if properly managed

Rich is having only money

Wealth is having both time and money

Wealth is measured in time, not in terms of money

ఆనందం long term

సంతోషం short term

1. మనసు ప్రశాంతము

2. సంతోషము

3. సుఖము

4. ఆరోగ్యము

5. ఆయువు

6. కాలము / సమయము

7. విజయము / విశ్వాసము

8. విద్య / జ్ఞానము

9. నైపుణ్యము

10. అనుభవము

11. సాహసము / ధైర్యము / వీరత్వము / ఆత్మ రక్షణ చాతుర్యము

12. శక్తి / పరాక్రమము / బలము / సమర్ధ్యము

13. నమ్మకము / విశ్వాసము

14. గౌరవము / పరపతి

15. వినయము / విధేయము

16. ధాన్యము

17. ప్రోత్సహించే తల్లితండ్రులు

18. ప్రేరేపించే గురువు

19. మద్దతిచ్చే జీవిత భాగస్వామి

20. ఉత్తేజ పరిచే తోబుట్టువులు

21. ఇల్లాలు

22. పిల్లలు / సంతానము

23. బంధు పరివారము

24. హితులు స్నేహితులు

25. సామంతులు / మందీ మార్బలము

26. ధనము / చర ఆస్తులు

27. స్థిర ఆస్తులు / అంతస్తులు / భవనాలు / భూములు / సముదాయాలు

28. మాణిక్యాలు / ఆభరణాలు

29. మణులు

30. వాహనాలు

31. ఆయుధాలు / వ్యూహాలు / పద్ధతులు

32. వ్యాపార సామ్రాజ్యము

33. సాంకేతికత / technology

34. సంస్థానము / రాజ్యము

సుఖంగా బతకాలి

శాంతంగా బతకాలి

అందరికీ ఆనందం కలిగించేలా బతకాలి

ఉన్న స్థాయి కంటే, ఉన్నతమైన స్థాయికి వెళ్లేలా బతకాలి

అందరి ప్రేమ పొందేలా బతకాలి

34 Incomes for your Financial Freedom

Passive Income

1. Pension

2. Interest on Bank Deposits

3. Warrants or Income from Commercial Papers, Bonds, Debentures, Company Deposits, etc

4. Dividends

5. Interest on hand loans

6. Annuities

7. Real Estate Rents

8. Income from Advance Selling

9. Income from Advance Buying

10. Stock Lending and Borrowing

11. Royalty

12. Passive Business profits

13. Regular or Yearly yield crops Agricultural Produce income (mango, coconut, jack fruit, etc)

Active Income

1. Stipend

2. Salary

3. Bonus

4. Incentive

5. Commission (social media platforms pay as commission)

6. Consultation

7. Honorarium

8. Affiliate income or Collaborations

9. Active Business profits

Lucky Income

1. Capital Gains from Real Estate

2. Capital Gains from Stocks

3. Profits from Asset Price Decline (Short Selling)

4. Betting and Gambling

5. Income from Skill Games / Races

6. Lotteries

7. Prizes

8. Lucky Draws

9. Gifts

10. Inheritance / Windfall gains / Previous Asset findings

11. Income from Short term agricultural crops

12. Income from Scams / Frauds

Five Pillars for Wealth Creation and Financial Success

MERIT

M – Mental Peace, Money, Materialistic Possessions, Loans, Derivatives, Leverage

E – Emotion, Expertise, Experience, Energy, Efforts

R – Responsibilities, Resources, Results, Relationships (Credibility, Clients, Customers, Share Holders, Stake Holders, Family, Professional, Friends, Relatives)

I – Intelligence, Insurance (Information, Knowledge, Skill, Experience, Expertise)

T – Time, Technology, Team, Thoughts

Earn, spend, save, invest, and grow income and assets with low or no risk

- Take a look at income tax provisions to understand types of income,

- Take a look at Court cases to understand ways to lose incomes and assets

- Anyone can earn, save and grow money, income and assets, but protection is key for long term sustenance (Inflation, Theft, Legal Risks etc)